bexar county tax assessor payment

Bexar County Tax Assessor Registration Services 233 N Pecos St San Antonio Tx Phone Number Yelp. The Bexar County Tax Assessor-Collectors Office is the only County in the State of Texas with a 10-month payment plan.

A property with an appraised value of 152400the median value in Bexar will be landed with an annual.

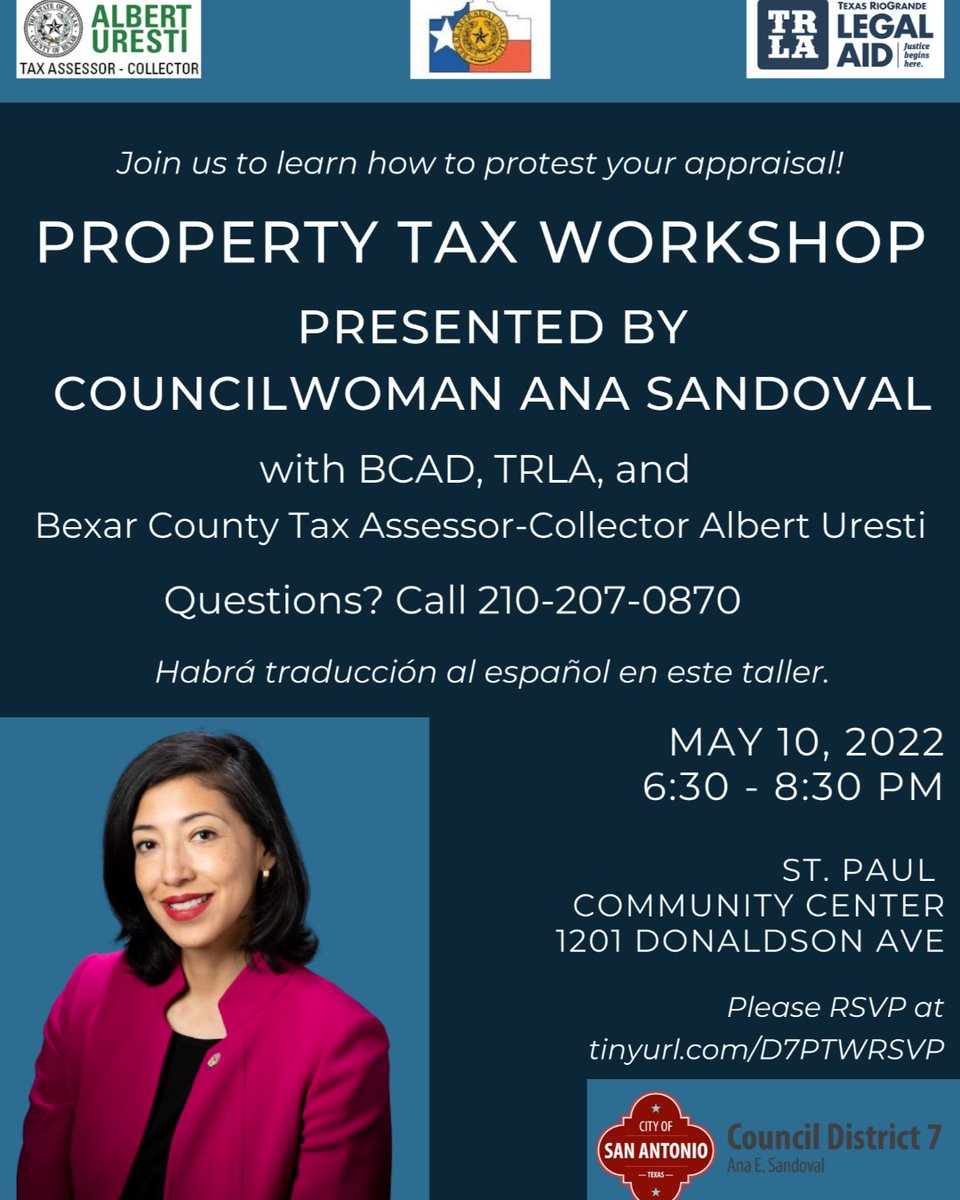

. For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers. County tax assessor-collector offices provide most vehicle title and registration services including. This service includes filing an exemption on your residential.

Each portfolio may consist of one or more properties and includes pertinent tax. For property information contact 210 242-2432 or 210 224-8511 or email. You can search for any account whose property taxes are collected by the Bexar County Tax Office.

Payment Information Begin a New Search Go to Your. Please follow the instructions below. You can search for any account whose property taxes are collected by the Bexar County Tax Office.

Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details. Southside - 3505 Pleasanton Rd. After locating the account you can pay online by credit card or eCheck.

Bexar County Tax Office. The 10-Month Payment Plan applies to a. County tax assessor and collector Albert Uresti says that residents have access to the 802 million in Payment Assistance Grants for Delinquent Property Taxes according to a.

Such as participating grocery stores. Credit card payments are processed through. You can pay by phone with your bank or credit card information.

You can pay Bexar County property taxes online via credit card or electronic check. Northeast - 3370 Nacogdoches Rd. This notice contains three important values.

To pre-pay their taxes in monthly installments through September 15. Bexar County and San Antonio residents who earn less than 80000 per year and are behind on either mortgage or property tax payments due to the pandemic may qualify for. The 86th Texas Legislature modified the manner in which the voter-approval tax rate is calculated to limit the rate of growth of property taxes in the state.

Bexar County property owners whose market value has increased by at least 1000 over the last year will receive a Notice of Appraised Value. Northwest - 8407 Bandera Rd. 2022-02-15 2020 2021 50000 Payment CLARENCE HALL 2021-11-23.

Owing Bexar County Delinquent Property. As a property owner your most. View any Justice of Peace case information and make related payments through the Justice the Peace Online Payments system.

2022 data current as of May 14 2022 115AM. Bexar county property tax payments annual bexar county texas. Thank you for visiting the Bexar County ePayment Network.

Please select the type of payment you are interested in making from the options below. The result is that Bexar County uses a property tax rate of 197 which is huge. Downtown - 233 N.

Bexar County Payment Locations. Tax bills are sent out in october and are payable by january 31. Property Tax Payments Online The Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check ACH.

Clicking on the link. Pecos La Trinidad. Bexar Appraisal District is responsible for appraising all real and.

Bexar County Tax Assessor Collector has 35 stars. Property taxes must be current Equal payments are due. Enter an account number owners name last.

Bexar Appraisal District is responsible for appraising all real and. The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically. You can create a portfolio if you want to group multiple tax accounts together for easier review and payment.

Of each tax year without penalty or interest.

Public Service Announcement Residential Homestead Exemption

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You

Bexar Talk Tax Assessor Collector Youtube

Bexar County Tax Assessor Registration Services 233 N Pecos St San Antonio Tx Phone Number Yelp

Cash Strapped Property Owners In Bexar County Face June 30 Tax Deadline Tax Deadline Bexar County County

Everything You Need To Know About Bexar County Property Tax

Public Service Announcement Residential Homestead Exemption

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Bexar County Offers Aid To Delinquent Property Taxpayers Community Impact

Albert Uresti Bexar County Tax Assessor Collector In San Antonio Tx Bexar County County The Collector

Everything You Need To Know About Bexar County Property Tax

Bexar County 2021 Property Tax Payment Due Monday Kabb

Chief Appraiser Expects A New Record Of Appeals To Be Filed Next Week In Bexar County

Bexar County Property Tax Loans Ovation Lending

Bexar Appraisal District Bexardistrict Twitter

Payments Bexar County Tx Official Website

Bexar County Tax Assessor Collector Taxes In North West San Antonio Parkbench